Your chance to take an insider look at the custom home building and renovating scene...

Friday, May 29, 2015

A whole New Way To Build: Insulated Concrete Forms

ICFs are rigid Styrofoam forms that hold concrete in place during curing and remain in place afterwards to serve as thermal insulation for concrete walls.

The foam blocks, or planks are lightweight and result in energy-efficient, durable construction. It is more efficient ways to build homes that are stronger, more comfortable and energy-efficient, while allowing for flexibility of design and lower future maintenance costs.

With ICFs, you can save time and money and get a stronger, more comfortable and more energy-efficient home.

The Following articles will explain the system and hopefully make you think before you chose a method for building your future home. More:

http://www.ontario-home-builder.com/custom-home-builder-insulated-concrete-forms.htm

http://luxury-home.ca/Insulated-Concrete-Form.htm

Saturday, May 23, 2015

6 Ways to Bring Down Your Mortgage Faster

A mortgage is likely one of the biggest financial commitments you’ll make; with a quarter of a million dollars on the line and thousands of dollars in interest – it’s important you take the time to understand the optimal way to bring it down faster, saving you thousands of dollars of your mortgage as a result.

While it’s important to always check the terms of your mortgage (to make sure there’s no penalties or fees with some of these tips), the following six tips can help you bring down your mortgage and help you save thousands of dollars in the process.

1. Commit to Making 13 Payments a Year

Making the commitment to pay an additional monthly payment is a sure-fire way to save money on your mortgage. By adding in the 13th payment, the payment is applied to the principal amount of the loan, instead of paying down a portion of interest with minimal impact on the principal.

The total impact of the savings can add up substantially over the years, saving nearly five years off the loan itself. Assuming there is a modest $1200 payment each year, you’ll save almost $47,000 in interest over the term of your loan.

2. Set Up Bi-Weekly Payments

Setting up a bi-weekly payment plan with your mortgage company is another simple way to save thousands of dollars of interest. By making bi-weekly payments you’ll make a collective total of 26 payments – which adds up to a gross amount of 13 months (instead of the 12 payments with monthly arrangements. Similar to the additional monthly payment, you’ll save approximately $47,000 off your term.

3. Save a Larger Down Payment

Not only can the down payment increase the total property allowance you’re allowed to have, saving a larger down payment for the property can also lower the overall mortgage amount you’ll pay. By saving a total of 20% of your total home value, you’ll drop the price down by substantial amounts – instead of increasing the total value of your home.

For example, if you had a property value of $200,000; applying the $40,000 can adjust the value to $160,000 if you apply the total down payment to the value of the loan. Likewise, you could also apply the $40,000 to the home value to $240,000 – which would give a larger portion of the loan, but would substantially increase the interest and overall cost per month.

4. Reduce Your Property Assessment

If you believe your home’s value has decreased over the year, there may be savings at hand if you decide to have the value reassessed by the government. To accomplish this, simply contact your assessor and fight the assessment by asking to have the home re-evaluated.

If in the event your home is determined to be of lower value, the tax assessment will also lower your yearly taxes – which can save you money, depending on your local tax rate.

5. Remove Your Canadian Mortgage Housing Corporation (CMHC) Mortgage Insurance

If the down payment on your home was less than 20% of the total home value, you were likely required to pay Canadian Mortgage Housing Corporation (CMHC) Mortgage Insurance. The insurance is mandated to lessen the likelihood of defaulting on your loan (protecting the lender in the event of a default).

Once you’ve paid down the premium to less than the 80% required of the home’s appraised value, you can petition to have the insurance removed.

There are a few ways the principal value can fall below the 80%; paying down the mortgage loan below the appraised value is one of the methods.

Alternatively, if your home has decreased in value, it may push the payment out of the 80% requirement. Attempting to remove your home’s CMHC Mortgage Insurance may require a new appraisal, but going through this process can save you hundreds of dollars off the monthly mortgage payment as a result.

6. Refinancing Your Mortgage

One of the most common ways to reduce your mortgage is to refinance your mortgage to a lower interest rate. By reducing your rate, you’ll also lower your overall monthly payment – which can help you improve the total interest you’ll have to pay throughout the term of your mortgage.

Although there are typically fees associated with the refinancing, the long-term savings out-weigh the costs of refinancing. With the interest rates being at an all-time low, re-financing is generally a safe bet for anyone looking to save money and bring down their mortgage faster.

Before deciding to implement any of the above tips, it’s important to speak with your mortgage provider prior to making a decision. While most companies are willing to help you implement these methods, some lending institutions do provide fees for these services. Be sure to ask about any fees they have and determine whether those fees are worth it when it comes to implementing them.

6 Ways to Bring Down Your Mortgage Faster

Thursday, May 21, 2015

Home Heating Guide

After we survived the coldest and the longest winter in recent history, we’re all glad that it’s finally finished and there is relief from bitter temperatures and the high cost of heating our homes.

The really bad news in Ontario is that the Ontario Energy Board uphold big increases for Enbridge and Union gas which took effect Apr. 1st. This means an increase of around $450 per year for the average family home.

Other natural-gas suppliers are expected to also apply for rate increases as they are forced to buy more expensive energy supplies on the open market. Households heating with propane and oil have already experienced a price shock. Propane customers in Ontario saw their home heating bills nearly double in January and February compared with what they were paying in November last year.

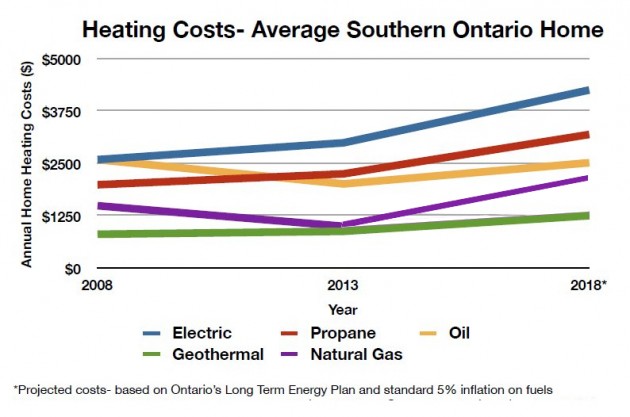

Here are some projections from Ontario’s Long Term Energy Plan:

Ontario’s climate means that almost two thirds of the energy we use in our homes goes to space heating.

No wonder we look to space heating when we think of energy savings

Before you start shopping for a home heating system, remember that significant gains in comfort and energy savings can be achieved quickly and inexpensively by making your home more energy-efficient. Doing so requires a series of relatively simple steps — most important, sealing leaks in the walls, ceilings and floors, and around doors and windows.

After the building has been sealed up, it’s time to pile on the insulation. Significant energy savings call for generous amounts of insulation that exceed current code requirements. Like caulk and weatherstripping, insulation not only reduces energy bills in winter, it also reduces heat gain in the cooling season, helping you slash your fuel bills while keeping you comfortable.

Ontarians have many heating choices: furnaces, heat pumps, boilers, solar or baseboard heaters—and a pick of different energy sources, e.g., gas, propane, oil, electricity or the sun. Some of us even use two or more types of heating and/or energy.

Selection of a home heating system for a new or existing home requires an understanding of how various systems operate, their initial cost, and how much they cost to operate.

Whether or not you’ve buttoned up your house, you can probably save a great deal by upgrading your heating system, either by installing a new high-efficiency system or boosting the efficiency of your present system.

Home Heating Guide – Basic Components of a Heating System

But first, when considering the various options for improving or replacing your heating system, it helps to know some of the lingo. A lot of confusing terms and concepts are thrown around by salespeople or heating system technicians, and you don’t want to get left behind.

Central heating systems have three basic parts: the heating plant itself where fuel is converted into useful heat, a distribution system to deliver heat to where it is needed, and controls to regulate when and how the system runs and when it turns off.

Selection of the most cost-effective heating system will depend on price and availability of differing fuels as well as cost of the ini- tial heater installation. Higher initial investments are often justi- fied by reduced utility costs over the lifetime of the unit.

Types of Heat Sources

Furnaces

Furnaces are one of the most common home heating systems, and they work by blowing heated air through a duct system. Furnaces are typically referred to as “forced-air” heating systems and can run on different types of fuel, but natural gas, oil, and electricity are the most common sources of energy currently available. Furnaces are more energy efficient than ever, but their cost varies based on fuel rates, electricity prices, and energy costs.

Boilers

Boilers heat water via natural gas, electricity, or propane—although the water doesn’t boil, as the name implies. As opposed to the forced air of the furnace system, most boilers move heat into your home through a radiant heating system like traditional radiators, baseboard heaters, or aluminum panels in a home’s floors, walls, or ceilings.

Heat Pumps

Heat pumps use refrigerant to absorb heat from outside sources—like the air, the ground, or even a body of water—and then use a heat exchanger to transfer it inside. (The exchange of heat can also be reversed in order to cool a home.) The most common kinds of heat pumps draw thermal energy from ambient air or the ground. Heat pumps in general are becoming increasingly popular heating choices for homeowners. Although air-source and ground-source heat pumps may be more expensive than conventional heating systems, they can provide significant energy savings to homeowners who live in temperate climates.

Solar Heating

Solar pace heating systems can be designed to heat the home directly or they can be designed to work in conjunction with domestic hot water systems. The latter will provide higher paybacks as you can use the system to provide hot water in the summer when space heating is not required.

When designing a space heating system it is best if you can store of buffer the energy when not needed, this can be done with a large water tank but a concrete slab such as a basement floor also acts as a great storage buffer. Using solar energy directly without a storage tank of buffer means that heat energy will only be available during the day and a backup heating source will be needed for the evening.

Electric Heating

An increasing number of homeowners with electric base-board heating are switching to other energy sources, such as natural gas, oil or heat pumps, because of the high cost of electric heating. While a major constraint is the lack of a distribution system, many homeowners find that air ducts for a central forced-air system, or pipes and radiators for a hydronic system, can be installed at a cost that still makes the whole conversion financially attractive.

Types of Distribution Systems

The majority of Ontario’s new homes and most existing homes have forced air distribution. Registers in each room can be adjusted to control the air flow. Return registers draw air from the rooms through separate ducts back to the furnace to complete the cycle of air flow through the house.

Hot Water (Hydronic) Heating

A hot water heating system distributes hot water from a boiler to radiators, convectors or under-floor heating systems in each room. In older homes, large cast-iron radiators are common. Modern systems feature smaller boilers, narrow piping and compact radiators that can be regulated to provide temperature control in each room. Under-the-floor heating systems can be built into the floors of new and existing homes.

Space Heaters

These have no central heating unit or distribution system. Instead, individual space heaters – such as a wood stove, electric baseboards, radiant heaters or heaters fueled with oil, natural gas or propane – supply heat directly to the room.

For safety, all space heaters except electric ones need to be vented to the outside. An appropriately-sized space heater can supply some heat to all parts of a home if the design of the home allows for natural distribution of heat from the heater location.

What’s the best option?

It depends. If you’re trying to save energy, understanding the most efficient home heating options is a great start. Households in temperate climates spend a hefty share of their energy budget on keeping their homes warm.

If you are serious about overhauling your current heating system, or building a new home with the most efficient home heating possible, you should start by understanding what different kinds of heating systems are available.

WHAT ARE THE MOST EFFICIENT HOME HEATING OPTIONS?

The most efficient home heating option is to make sure your home is as well insulated and air-sealed as possible to prevent heat escape, and to use as efficient, cheap, or low-carbon a source of energy as possible. Let’s assume you already know how important proper sealing and insulation is, and that you’re going to take care of that no matter what. What are the most efficient home heating choices, in terms of new systems you can install?

Here are the main choices, from most efficient home heating system, to least efficient:

- Solar heating

- Geothermal heating

- Wood heating

- Natural gas heating

- Oil heating

- Electric heating

Note that when we talk about the most efficient home heating choices, we could be talking about efficiency from the point of view of financial cost, environmental cost (greenhouse gas emissions plus other pollutants), or the efficiency of conversion of the original energy source into heat inside your home.

For financial cost we can consider lifetime costs (installation plus yearly energy costs) or just installation or yearly costs.

For energy conversion efficiency (what most people are really interested in when asking about the most efficient home heating system), we can start from the assumption that solar is free, and geothermal is almost free, since up to 4 times as much heat energy is extracted from the ground as the energy in the electricity that pumps the heat out.

Home Heating Guide

Monday, May 11, 2015

7 Secrets to Designing Your Dream Home

Having a custom home built for your next property is a major investment in time and expense, so it’s important that you have it designed to specifications that fit not only your lifestyle but on-going needs too. If you’ve never had a home built before, the decision making can be overwhelming; that’s why we’ve compiled a list of seven secrets you can use now – to design the perfect dream home for you and your family.

1. Start a List of Must Have Items in Your New Home

Before you start working out the finer details of your home’s build, it’s important to consider which elements are absolutely unforgiving in the layout and which items are more flexible in terms of the overall design.It’s important to consider the natural flow you’re hoping for within the home too; do you want an open concept plan or something more traditional? Do you require a single, spacious area or would you rather have a private dining room for family functions? Grab a piece of paper and start writing out the pros and cons of each idea – to see what works best within your family. Likewise, determine how many bedrooms you’d like the home to have as well, taking into consideration any future family additions down the road.

2. Daydream About the Final Product

Take a look through various magazines, websites and photographs of different styles of homes – noting what you like and don’t like about each of the rooms you see. Pay attention to the colours, floor plans, finishing materials and design—as these can help you shape your custom home build too. If you find something you love, save the image to show your builder – especially if you’d like to replicate the image. The builder can let you know whether the design will match well with the current floor plan or whether they’d need to accommodate your request in a different way (such as reducing the cabinets in the kitchen, if space is limited).

3. Think About the Big Picture

Many home owners think solely of their current situation (family and children, finances, finishes) that they forget to plan for the future too. When you’re planning your home, it’s important to remember that life’s circumstances change quickly – whether that means having more children or caring for an elderly parent. Discuss important details about future events with your builder; like adding an in-law suite into the basement or roughing in an additional bathroom downstairs. These are all items that can save you money long-term, instead of adding them in later.

4. Upgrades During the Build Means Less Improvement Later

When you’re planning your custom home build, it’s important to remember that the home is built to your specifications and requirements. Often times, home owners opt for a cheaper finish (laminate over granite, for instance) with the idea of changing it at a later time. This mentality is backwards of what should happen; opt for upgrades which can be enjoyed throughout the years – instead of setting yourself up for additional work down the road. The last thing you’ll want to do is remodel your kitchen in five years, when you finally want the granite.

5. Know Your Budget and Compromise on Design

Looking at your list of must-haves, determine which items are the most important. While having a custom stone bathroom might be a nice feature, sacrificing a fourth bedroom to achieve it is impractical. Consider which of the items on your list would offer the most benefit to your family and make sure you have those items in place. Once you’ve narrowed your options down, reassess your budget to factor in any upgrades you’d still like to have – within a price you can afford.

6. Talk to Your Builder About Specifications

An experienced home builder has seen hundreds of homes developed and built throughout the years; trusting his opinion on design and floor planning is a wise decision. If you’re not sure of the optimal finishes for durability or longevity, ask his opinion. He’ll give you a fair assessment of different materials, giving you the tools you need to make a final decision.

7. Determine the Costs of Upgrades Over Time

Looking at the individual costs of upgrades can scare even the most experienced home developer – but it’s important to understand these costs only offer a small picture of the home. When you’re having a custom home built, you’ll be building a home to your ideal design and specification – meaning you’ll have less overall renovation requirement down the road.Many times, the costs of high-end upgrades (like commercial appliances in the kitchen or floor heating) can have a minimal impact on your final purchase price of the home. This means your monthly mortgage payment might increase by a few dollars at the end of the build – instead of paying the expenses in a lump sum.

7 Secrets to Designing Your Dream Home

Friday, May 08, 2015

Insights From the Mind of the Homebuyer

As the busiest homebuying season of the year gets under way, potential buyers are poised to get off the sidelines and enter the market.

According to Chase’s national survey “Insights: From the Mind of the Homebuyer”, potential home buyers say they aren’t concerned about navigating the home-buying process, but a deeper look shows that their anxiety about the homebuying process is high. In fact, interested buyers are considerably more anxious about the buying process (70%) than they are about getting a root canal (64 %) or public speaking (62 %).

Homebuyers are optimistic that it’s a good time to buy but they anticipate challenges. Besides interest rates, Chase’s survey found that interested buyers are concerned about finding the home they want within their budget. Three out of four buyers are worrying about beating out the competition to get it.

Only one in four interested buyers correctly answered a series of questions about home buying, including how annual percentage rates work, how much should they put down for down payment, and how credit scores work.

The majority of interested buyers (62%) think that now is a better time to purchase a home compared to last year and plan to purchase the new home in the next 18 months. Top reasons they want to buy now include rising rental costs and historically low interest rates.

Whether shifting from renting to buying, or upgrading from their current home, potential homebuyers want to make a move before interest rates begin to rise, as some analysts predict.

As for their motivations for buying, 32% attribute it to current low mortgage rates. Another 35 percent said if 30-year fixed mortgage rates were to rise above 4%, it would delay their purchase. An additional 20 percent said upgrading from their current home was their motivation for buying.

The survey also revealed insights into homebuyers’ concerns and challenges.

The majority of potential homebuyers are concerned about finding a home that fits within their price range (56%) and that’s located in a quality neighborhood (56%). Buyers are clearly worried about housing inventory and rising prices, especially during the competitive spring buying season,” But the research also shows that interested buyers are optimistic and ready to act on their goals.

Quick stats from the “Insights From the Mind of the Homebuyer” survey:

- 43 percent of potential home buyers feel that getting a mortgage will be easier this year.

- 56 percent say they are concerned about finding a home that fits within their budget and that’s located in a quality neighbourhood.

- 32 percent want to buy soon in order to take advantage of low rates;

- 35 percent say that 30-year fixed mortgage interest rates rising above 4 percent would delay their decision to buy

- 20 percent say the rising cost of rent is their number-one reason to buy

- 20 percent say the desire to make an upgrade from their current home was their top reason to buy

- 70 percent of those surveyed said they thought they may have missed their opportunity to buy already, as home prices are increasing.

- 3 out of 4 homebuyers are concerned their offer will be outbid by others

- 73 percent said they’d give up things like eating out and taking vacations in order to buy their dream home.”

- 42 percent say they aren’t at all concerned about lacking understanding of the mortgage process.

In addition, the survey revealed tensions among homebuying couples:

One-third of homebuying couples have been bickering with their partner during the process. One reason for the spats may be the budget.

Men and women differed in their feelings on how important it is to stick to the budget; about half of women (49 percent) say they are more conservative than their partner and don’t want to go beyond their agreed-upon budget, while 39 percent of men say they are less conservative than their partner and are willing to push their budget limit to get the home they want.

Insights From the Mind of the Homebuyer

Wednesday, May 06, 2015

10 Coolest Automation Products for Your Home

Home automation products, while not new, haven’t gained widespread adoption. However, interest continues to build. Among all consumers, 48% said they were either “extremely or somewhat interested” in purchasing home automation products. Among smartphone and tablet owners, the numbers are higher with 62% of consumers saying they are “extremely or somewhat interested” in purchasing.

With families becoming busier than ever, it’s important to stay on top of the newest advances in making our lives simpler. That’s why we love discovering new products that offer innovative solutions to constantly being on the go. Here are the top ten automation products for your home that we think you’re going to love.

1. Home Control Systems

These automated systems work perfectly with almost any device that accesses the internet – making them an accessible product that makes life simpler. They typically come with built in features that help keep your home safe and secure while you’re not home. You’ll be able to access your home’s lights, alarm system, thermostat, security cameras and door lock systems – using an online portal (like a smart phone or computer).

2. Automated Light Switches

Perfect for outdoor lighting systems or virtually any room in the house, these automated light switches make the perfect accessory to an individual on the go. Simply access your app with any device compatible with WI-FI and turn your lights (or electronics) on or off effortlessly. Pay attention to the programming requirements for the automated light switches – some require an Apple product, where others allow basic WI-FI access to use.

3. Wireless Camera Monitoring Systems

Long gone are the days of installing large clunky security cameras; new wireless security and monitoring systems take only seconds to set-up and offer exceptional viewing capacity. With automated recording, two-way talk, scheduling options and comprehensive software – these cameras can help keep your home safe and secure, even when you’re thousands of miles away.

4. Automated Thermostat Products

Although programmable thermostats have been around for a long time, new wireless options are making home comfort a top priority. New systems have been designed to control and monitor the temperature in your home based not only on a set degree – but on the indoor and outdoor temperatures and humidity levels too. This helps regulate the actual temperature, giving a better climate control over all.Systems also work with most smart phone systems, meaning you can adjust the temperature inside your home, from virtually anywhere.

5. Automated Electronics with Motion Sensors

Control your home electronics and appliances by using movement as the switch. By installing a motion sensor switch, your home will only use the items (like a television or light) when you’re in the room. You can use the system to arrange lights to turn on when you arrive home – without having to fumble in the dark or turn off a fan or appliance when you leave.

6. Electronic Door Lock System

Never worry about forgetting your key again with new automated door locking systems. These systems install much like a traditional deadbolt, however you’ll also receive a wireless ability to lock and unlock your door with a simple touch (provided you have your smart phone with you.) Most systems also work on a key fob system, which is ideal for families with children needing to let themselves into the home.

7. Automated Kitchen Appliances

For families on the go, finding the time to eat together can be nearly impossible. Factor in the time it takes to prepare and cook the meal – and it can be a lengthy process. That’s why new improvements to everyday kitchen appliances are so important.New appliances are programmable to work with your smart phone – adjusting the temperature, cooking time, starting and stopping the appliance—all with the touch of a button. You won’t have to worry about hitting traffic on the way home, or over cooking your pot roast again.

8. Smart Energy Switches

Much like the automated light switches, automated energy switches can be controlled with most smart phones or electronics with WI-FI access. You’ll be able to log into the software or app and automatically turn off the power to any device that is plugged into it – saving you costly wasted energy throughout the year.

9. Automated Smart Cam Products

If you’re stuck at the office have peace of mind throughout the day with an automated camera system. They can be installed virtually anywhere within the house – connecting you to a live-time view of your home while you’re away. You’ll be able to check in on the kids, pets or property from virtually anywhere with an internet connection; using audio and motion detection and two-way talking options too.

10. Lawn Maintenance and Irrigation Systems

Whether you’re on vacation or simply don’t have the time to maintain your grass on a daily basis, automated lawn care systems are easily installed for home owners on the go. With the ability to set the time and duration of watering – you’ll never be left with burnt grass again. Most systems include pop-up style irrigation systems meaning you’ll never trip over sprinklers again when you’re outside enjoying the sun.

10 Coolest Automation Products for Your Home

10 Coolest Automation Products for Your Home

Home automation products, while not new, haven’t gained widespread adoption. However, interest continues to build. Among all consumers, 48% said they were either “extremely or somewhat interested” in purchasing home automation products. Among smartphone and tablet owners, the numbers are higher with 62% of consumers saying they are “extremely or somewhat interested” in purchasing.

With families becoming busier than ever, it’s important to stay on top of the newest advances in making our lives simpler. That’s why we love discovering new products that offer innovative solutions to constantly being on the go. Here are the top ten automation products for your home that we think you’re going to love.

1. Home Control Systems

These automated systems work perfectly with almost any device that accesses the internet – making them an accessible product that makes life simpler. They typically come with built in features that help keep your home safe and secure while you’re not home. You’ll be able to access your home’s lights, alarm system, thermostat, security cameras and door lock systems – using an online portal (like a smart phone or computer).

2. Automated Light Switches

Perfect for outdoor lighting systems or virtually any room in the house, these automated light switches make the perfect accessory to an individual on the go. Simply access your app with any device compatible with WI-FI and turn your lights (or electronics) on or off effortlessly. Pay attention to the programming requirements for the automated light switches – some require an Apple product, where others allow basic WI-FI access to use.

3. Wireless Camera Monitoring Systems

Long gone are the days of installing large clunky security cameras; new wireless security and monitoring systems take only seconds to set-up and offer exceptional viewing capacity. With automated recording, two-way talk, scheduling options and comprehensive software – these cameras can help keep your home safe and secure, even when you’re thousands of miles away.

4. Automated Thermostat Products

Although programmable thermostats have been around for a long time, new wireless options are making home comfort a top priority. New systems have been designed to control and monitor the temperature in your home based not only on a set degree – but on the indoor and outdoor temperatures and humidity levels too. This helps regulate the actual temperature, giving a better climate control over all.Systems also work with most smart phone systems, meaning you can adjust the temperature inside your home, from virtually anywhere.

5. Automated Electronics with Motion Sensors

Control your home electronics and appliances by using movement as the switch. By installing a motion sensor switch, your home will only use the items (like a television or light) when you’re in the room. You can use the system to arrange lights to turn on when you arrive home – without having to fumble in the dark or turn off a fan or appliance when you leave.

6. Electronic Door Lock System

Never worry about forgetting your key again with new automated door locking systems. These systems install much like a traditional deadbolt, however you’ll also receive a wireless ability to lock and unlock your door with a simple touch (provided you have your smart phone with you.) Most systems also work on a key fob system, which is ideal for families with children needing to let themselves into the home.

7. Automated Kitchen Appliances

For families on the go, finding the time to eat together can be nearly impossible. Factor in the time it takes to prepare and cook the meal – and it can be a lengthy process. That’s why new improvements to everyday kitchen appliances are so important.New appliances are programmable to work with your smart phone – adjusting the temperature, cooking time, starting and stopping the appliance—all with the touch of a button. You won’t have to worry about hitting traffic on the way home, or over cooking your pot roast again.

8. Smart Energy Switches

Much like the automated light switches, automated energy switches can be controlled with most smart phones or electronics with WI-FI access. You’ll be able to log into the software or app and automatically turn off the power to any device that is plugged into it – saving you costly wasted energy throughout the year.

9. Automated Smart Cam Products

If you’re stuck at the office have peace of mind throughout the day with an automated camera system. They can be installed virtually anywhere within the house – connecting you to a live-time view of your home while you’re away. You’ll be able to check in on the kids, pets or property from virtually anywhere with an internet connection; using audio and motion detection and two-way talking options too.

10. Lawn Maintenance and Irrigation Systems

Whether you’re on vacation or simply don’t have the time to maintain your grass on a daily basis, automated lawn care systems are easily installed for home owners on the go. With the ability to set the time and duration of watering – you’ll never be left with burnt grass again. Most systems include pop-up style irrigation systems meaning you’ll never trip over sprinklers again when you’re outside enjoying the sun.

10 Coolest Automation Products for Your Home

Monday, May 04, 2015

8 Ways to Get Cheap Financing for Your New Home

Purchasing a new home takes a major commitment; especially when you’re trying to finance the home as cheaply as possible. Banks and lenders seem to be all over the board when it comes to interest rates and amortization periods – making your decision a tough one.

Fortunately, we’ve compiled eight ways to secure cheap financing for your new home. Follow these tips before securing your lender, if you’re hoping to save some money on your mortgage.

1. Make sure your credit score is excellent.

The key to securing low interest financing starts with your credit score; looking at not only your total debt ratio but your employment too. That’s why it’s critical to stay on top of any changes to your credit – reporting them immediately if they’re found incorrectly on your report.

Accidents within your credit report can and do happen – whether that’s a mix up in reporting or a forgotten account that’s gone to collections. Take the time to go through your report and fix any outstanding issues before you try and find a lender.

2. Create a Sizable Down Payment

Banks and lenders like to see commitment from their customers – which starts with the long-term savings goal. Instead of opting for the standard 3.5% down payment, aim to save 20% of your home’s value.

Invest the savings into a high-interest account that remains untouched over a period of time for the maximum return on your investment. It’s important to remember that while saving the money for a down payment might be difficult; showing the lenders you’re committed to purchasing a home is the ultimate goal.

By having the 20% of the value, you’ll not only show the banks your commitment to your debts, you’ll also reduce the overall mortgage costs too. This means you’ll have less mortgage payments, lower interest on the loan and a higher likelihood of securing financing.

4. Consider Long Term Mortgages

Although amortization periods can be as little as 5 years, if you’re willing to extend the repayment period to 30 years – you’ll pay a lower amount of money per month than the shorter time frames. The draw back to extending your term is paying a higher interest rate total on the mortgage amount.

5. Build Loyalty with a Bank or Lending Institution

Having other services with a lending company shows a long-term commitment with the company overall, which many banks like to see at the time of approval. By having other services (like short-term loans, banking accounts, or insurance) with a banking or financial institution, they’ll be able to see your long-term history through the accounts. Short term loans can also give them a bigger picture on your payment history as well – so make sure any payments are current and up-to-date.

6. Look Beyond the Interest Rates

If you’re looking to secure cheap financing it’s important to look past the interest rates of the loan. Many times, it’s not necessarily the interest that will affect your overall payment; it’s the additional fees that can add up quickly. Read through the contracts carefully, looking at underwriting costs, document preparation fees and any other costs within the contract. Compare the total monthly payment (or mortgage amount) with some other lending institutions.

7. Be Honest on Your Loan Applications

It’s important to be open and honest with a lending company – especially if you’re trying to secure a mortgage. Avoid inflating your monthly income, savings accounts, investments or the like – it’ll only cause you problems when it comes time to an approval.

Lending companies like seeing a clear ability to pay down the debt; looking at the total picture of repayment, instead of specific numbers. Lending institutions also like seeing stability with employment, showing a regulated monthly amount coming in every month too.

Make sure that you’re honest about how long you’ve worked for a company, as they’ll pull your information up on the credit report (or through CRA websites). Make sure you’ve been consistently working for the last 24 months to improve your chances of approval – and receiving cheap financing. Fudging your monthly income or inflating the amount of time you’ve been with a company can result in delayed approval, or an automatic rejection.

8. Find a Co-Signer for the Mortgage

If you’re finding it difficult to secure cheap financing, consider asking a friend or family member with amazing credit to co-sign on the application. Many times the additional applicant can help improve the overall credit allowance, giving you a higher approval rate than using a sole income alone.

It’s important to remember, however; the person co-signing on the loan will be responsible for the debt in the event you default or declare bankruptcy. Make sure you have a clear guideline of how much you can afford (even if you’ve been approved for more) to limit the risk of defaulting.

8 Ways to Get Cheap Financing for Your New Home